We were talking about pleasure. You know what’s also pleasurable? Financial security. Some of us are more fiscally and financially motivated. We live in a culture of consumer debt. That does NOT mean this is a good thing. In fact, I read a statistic that says 46% Canadians are $200 away from insolvency. Not cool, guys. Not cool.

Now I’m not saying that your fashion choices are going to magically solve all your problems – hello cost of living in Toronto!! – but I’m saying they are going to make a difference. Sure you may spend your money on experiences than things, or alterations, but trust me when I say it all has a trickle down affect.

As your priorities change and as you spend less time shopping by physically stopping yourself from doing so, you’ll just naturally spend less money. Buy ten tops costs a lot more than a pint of beer and french fries as you laugh four hours away – trust me, I’ve done it. The beer and fries part.

Also, it’s a lot easier to spend $25 twenty times unconsciously, than to make one sustainable/vintage purchase of $125. Because that’s a lot to drop at one time – at least it is for me, and if it isn’t for you, can I please have your income level??? When you’re dealing with that large total staring you in the face you’re more likely to pause and reflect. And in the long run, buying that once, saves you a ton of money. ($375 in case you were doing the math here).

We all shy away from talking about money. But why? There is nothing wrong with saying, “I’m not buying that because I can’t afford it.” It’s empowering to own your own financial situation and to take control of it.

For the record, I’m talking about people who are not struggling with basic living income, I’m talking about consumer debt. Real poverty and difficulty is not applicable to this conversation. And please know, that I’m very familiar with genuine poverty.

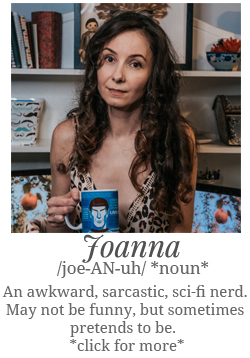

Dress – Shopruche *now closed*

Boots – vintage/thrifted

NO COMMENTS